How arbitrage impacts propane retailers

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, reviews how arbitrage impacts propane retailers.

Catch up on last week’s Trader’s Corner here: Propane production and where it comes from

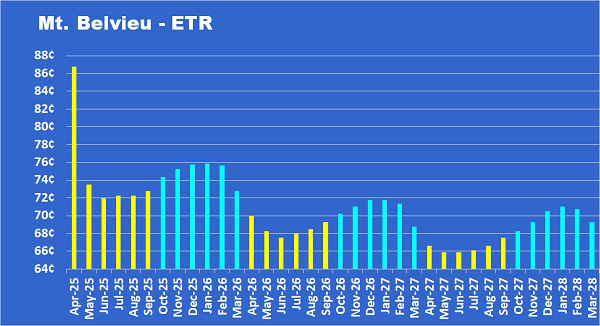

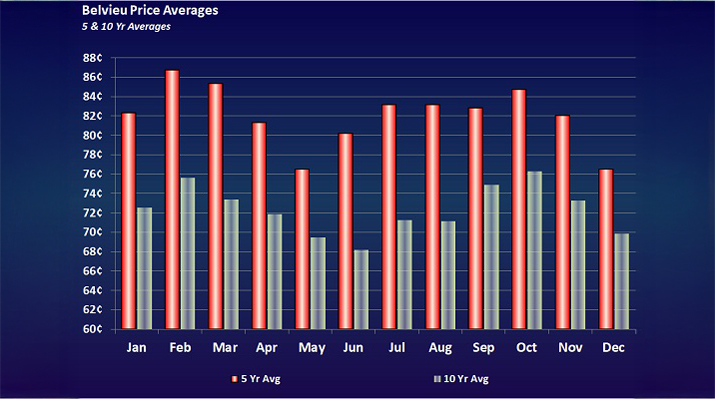

Propane had a sneaky bullish week that ended on Aug. 25. Propane overall moved higher than crude, and Mont Belvieu prices notably outpaced Conway. As we talked to traders, it appeared export demand, or at least anticipated export demand, was behind the strength, which makes sense given the superior performance at Mont Belvieu. Mont Belvieu is influenced more by exports than the Conway market.

When talking to traders, they said the arbitrage window is wide open. Traders just love the term arbitrage. Arbitrage means: The simultaneous buying of securities, currency or commodities in different markets or in a derivative form to take advantage of differing prices for the same asset.

If I own a boat in the desert, its value is probably low if I try to sell it where I live. Prices are likely better around the Great Lakes. If I advertise my boat for sale around the Great Lakes, get a reasonable offer, and the cost of transporting it there is less than the lower price I am offered at home, it will benefit me financially to take advantage of the arbitrage.

Propane retailers deal with arbitrage every day because the price of propane in their market is going to be more than the price of propane at Mont Belvieu or Conway. Similarly, the price of propane in the U.S. is less than the price of propane in Europe and Asia. So, when traders say the arbitrage window is wide open, it means that a seller can easily cover load, transport and unload costs to move propane from the U.S. to overseas markets and make a better profit than selling it here.

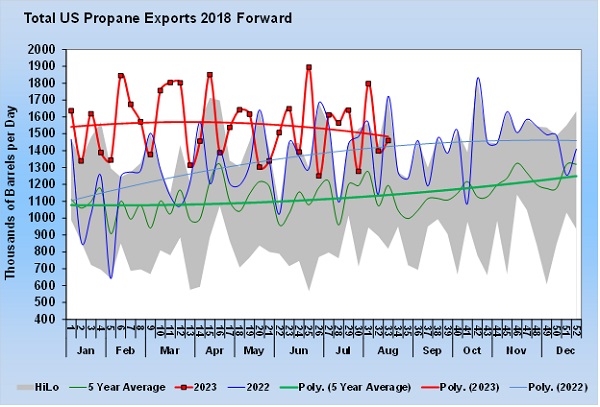

Despite good export economics and strong export activity at the beginning of the year, exports have been trailing off recently.

Exports are volatile week to week, so focusing on the smoother trendlines makes it easier to evaluate. In Chart 1, the red line is this year, and it is easy to see how much higher exports were at the beginning of the year over last year (blue line) and the five-year average (green line). But more recently, the trend is lower and close to intersecting with last year’s level. U.S. domestic demand has been increasing to offset some of this decline. But, with U.S. propane production recently jumping, downward pressure on prices is likely if the export trend stays in its current trajectory.

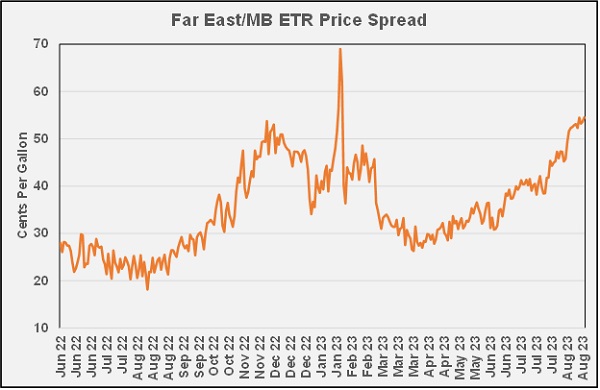

Chart 2 shows the price difference, or arbitrage, between the Mont Belvieu and Far East markets. Export economics have been favorable for a while. Softness in exports would more likely be due to overall weak economic conditions. But you can see how the spread has been increasing, especially this month. It is certainly easy to imagine such an arbitrage would encourage more U.S. exports if there were any demand out there. Plenty of headlines highlight the discouraging performance of the Chinese economy.

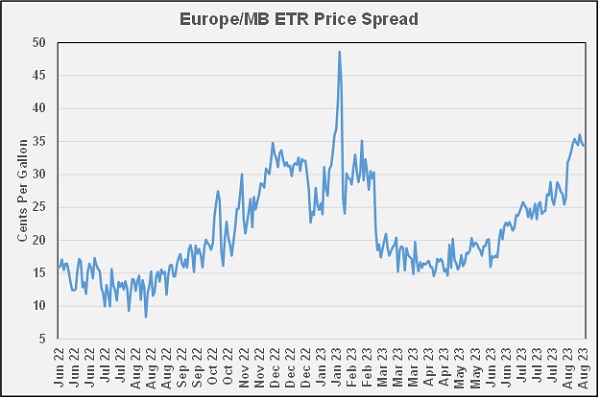

The arbitrage between the U.S. and Europe is not as high, but neither is the transportation cost. The economics are still favorable to export propane there. We have been surprised there has not been more demand for U.S. propane from Btu-hungry Europe since the Russia/Ukraine war began. The combination of a mild winter and weak economic conditions is a factor.

But Europe is causing a shortage of distillates as it has used them to offset the loss of natural gas from Russia for power generation. That is a key reason U.S. heating oil is trading at the equivalent of $2.11 propane. You would think there would be more propane-fired turbines used for electrical generation in Europe given that propane is a cheap Btu. Those projects take time and money to develop, however. We believe there was a lot of hesitancy to make those commitments early in the war due to the uncertainty of how long it would last. The natural gas will start flowing again as soon as the war ends because it will greatly benefit both Russia and Europe. But right now, power generation using propane would likely be a golden opportunity.

The arbitrage is begging for propane to move from the U.S. to Asia and Europe. However, there must be demand on the other end to take advantage of the arbitrage. The improvement in propane’s price this week coupled with traders’ comments suggest that some believe demand is coming. If overseas demand does improve, and there is certainly room and reason for it to do so, it could be happening as the U.S. heating season kicks off. That will keep upward pressure on prices until the arbitrage dwindles to discourage exports. Such is the ebb and flow of supply and demand with any commodity.

A propane retailer looking at U.S. propane inventory at five-year highs for this time of year must be wondering why propane prices are increasing. The answer is in anticipation – or even in preparation – for more export demand. The question is whether that demand will fully develop. If it doesn’t, increased propane production coupled with the high inventory position will see downward pressure on propane prices resume. Keep a close eye on export volumes in the coming weeks leading up to the heating season.

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.