Is it a new era for natural gas pricing?

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains what’s happening with natural gas pricing and how it could affect propane prices.

Catch up on last week’s Trader’s Corner here: It’s actually good when price protection doesn’t pay off

Natural gas pricing doesn’t impact propane prices much. Propane prices off crude, so that is where we spend most of our time and effort in analysis. However, about 90 percent of propane supply comes from natural gas processing, which makes natural gas important to those of us that put bread on the table by participating in the propane industry.

We have written several Trader’s Corners recently about the process related to obtaining propane supplies. It is important to remember that much of the growth in natural gas and propane supplies comes as associated production from the drilling and production of crude wells. When a production company develops a crude field to get the heavier hydrocarbons that they need for their refineries, they also recover natural gas (methane) and natural gas liquids, which include propane.

When producers are going after one thing and get other things, it can cause oversupply for the associated or secondary commodities that are recovered. This has been the case for both methane and propane.

You can imagine a meeting of production company decision-makers. They propose to drill for crude (heavy hydrocarbons) in the Permian Basin to supply refineries on the Gulf Coast.

During the meeting, someone says, “If we go after the heavy hydrocarbons, we will get light hydrocarbons as associated production. Those light hydrocarbons are oversupplied, and we will contribute to their price going down more if we drill this well.”

Many of the other decision-makers would look at the person making that statement and say, “So what? We need heavy hydrocarbons.”

The well gets approved despite its contribution to methane and propane oversupply.

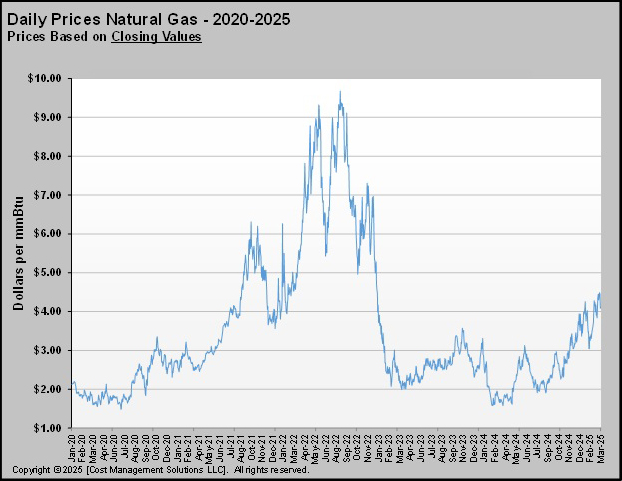

Because these types of decisions are happening a lot, we have been in a period of low methane and propane prices. The chart below provides the history of natural gas prices since January 2020.

In a recent Trader’s Corner, we discussed the shale revolution, when prices got high enough to justify the high cost of production from shale formations. It was natural gas prices that reached that point before crude. Natural gas (methane) reached more than $14 per MMBtu in 2005, which was the equivalent of $82 crude covering the expected $70 production cost. This move relieved the shortage of natural gas, causing prices to fall. Then in 2008, it became economically viable to recover crude from shale formations. This was when the associated production began that oversupplied natural gas and propane.

You can see in the chart that in early 2020 methane was valued below $2 per MMBtu. That is the equivalent of $11.77 per barrel crude and 18 cents per gallon propane. Again, there is not a lot of interest in drilling specifically for methane at that price, but supplies still grew because of associated production.

Natural gas prices started recovering leading up to Russia’s invasion of Ukraine. A consequence of the invasion in February 2022 was natural gas supplies from Russia to Europe mostly stopped. The buildup to the invasion and the consequences of the invasion itself resulted in the spike in natural gas prices that peaked in late 2022.

The United States more than doubled its ability to export liquefied natural gas (LNG) to help Europe with natural gas supply. It took some time to build out the LNG export capacity. Even though prices became extremely high in Europe, U.S. prices fell back to pre-invasion levels by early 2024.

But more recently, natural gas prices have been on the rise. Of course, a key cause was higher demand for heating in the Northern Hemisphere this winter. Despite knowing heating demand was a key contributor, we still wonder if perhaps we have entered a new era for natural gas pricing where it will not go down to the sub-$2 level again.

Frankly, we can’t answer that question. We can explore factors that will have a major determination on whether that will be the case, however.

- What happens if the war in Ukraine ends? Are we back to oversupply again? Europe says it will not go back to buying natural gas from Russia. We sincerely doubt that. Money talks, and after the emotions of the war are past, we suspect wallets will have more sway on where supplies are coming from. The cheapest by far for Europe will be Russia.

- If Russian natural gas starts heading to Europe again, what happens with U.S. LNG exports? No way U.S. LNG can compete with pipeline-supplied Russian natural gas. We hear many saying that Asia is primed and willing to take any U.S. LNG that Europe stops taking, but that remains to be seen.

- Another factor on the horizon that is likely to be supportive of natural gas prices is the need for electricity generation. There is a tremendous amount of talk about how much new power is going to be needed to run cloud computing for artificial intelligence and cryptocurrency mining. Non-hydrocarbon options to meet this demand are not going to be enough. In fact, those options are not even keeping up with normal demand growth. Natural gas is extremely flexible in this regard, and we must believe that natural gas-powered electricity generation will be a key component in supplying new electricity demand.

Even at the $4-per-MMBtu level that natural gas has been trading for recently, it is still the equivalent of $23.50 crude. So, most drilling will remain for crude, and associated methane and propane supplies will still account for the growth in supply for those two.

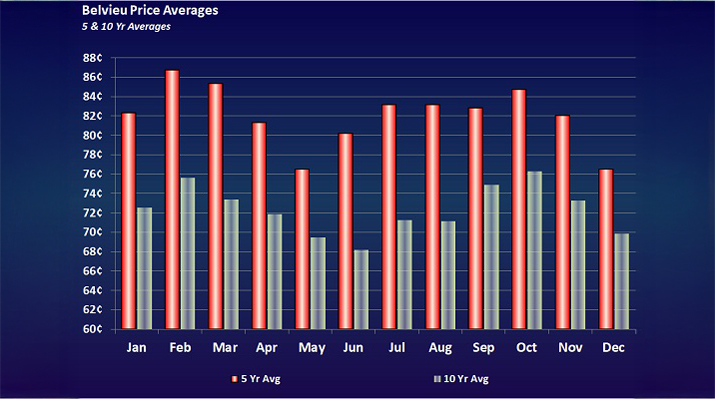

There is a point where natural gas prices do impact propane prices, but we are a long way from that point. Remember when we discussed the natural gas processing stream, we talked about natural gas processing plants near the production fields that take out the methane and sell to the natural gas utility companies. Normally, most of the propane goes along with the other natural gas liquids to the hubs. Since propane is valued at so much more (85 cents Mont Belvieu versus methane’s value at the equivalent of 36 cents propane), the propane will be sent to the hubs with the rest of the natural gas liquids. But if methane’s value gets high enough, the natural gas processing plants will leave some of the propane with the methane and sell it to the natural gas utility companies. This is called propane rejection. It would take natural gas prices reaching $9.40 per MMBtu at today’s propane price to make rejection happen. Methane just touched that price briefly after Russia invaded Ukraine, so there is little chance of that happening in most scenarios one could imagine at this point.

We are not sure if we are heading to $4-plus natural gas being the norm going forward. But we do believe the price will stay low enough to avoid rejection that would hurt propane supplies and raise propane prices. We also believe that there will be enough associated production to keep propane supplies robust for the foreseeable future.

That means it will be changes to the demand side that will have the most impact on propane prices. As we have stated many times recently, it is about 600,000 barrels per day of new propane export capacity due online this year and next that is the most likely to reset propane prices higher. Propane prices are unlikely to be impacted by rising natural gas prices or a shortage of supply. The price rise will come as the new export capacity will increase competition for the domestic market for that supply.

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.