Playing the averages may mean missing an opportunity

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, warns against getting price protection for the next winter.

Catch up on last week’s Trader’s Corner here: Ready-for-sale propane data making an impact

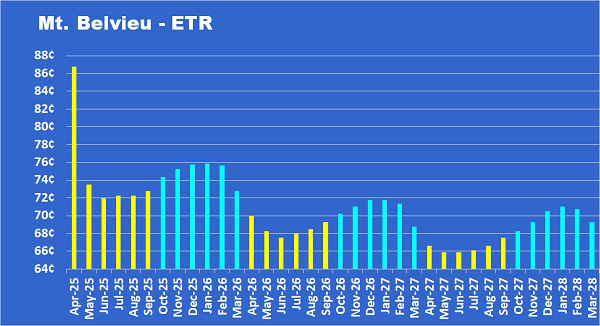

In late February, with Mont Belvieu ETR propane valued at nearly $1, one of our clients called and asked if he should be locking down propane supply for next winter because one of his suppliers had just told him that prices were only going to go higher.

No.

I would rather have wolves gnawing at my guts than agree to such a thing. OK, that may be a little dramatic, but still, no.

How about this? No. I would rather go next winter without a gallon of price protection than lock in when prices are near the five-year price average and about 10 cents above the 10-year average with summer still ahead. I don’t know, the wolves’ image still more accurately reflects how I feel about it.

For fun, let’s contemplate a conversation between a propane retailer and his customer next winter if propane is valued at its 10-year price average. Customer: “Why are we paying 10 cents higher than everyone else for propane?” Retailer: “Last February, right after a major winter storm that saw record low temperatures, propane prices spiked, and a supplier told me prices were only going to go higher. So, I locked this winter’s price at that time.” OK, let’s try and imagine the look on the consumer’s face. Got it? Yeah, it isn’t good, is it?

I think I would much rather say, “Propane prices never dropped low enough after last year’s winter storm for me to feel comfortable locking in price protection for this year, so we are just having to ride current market prices.” Granted, the consumer’s facial expression will be the same in either case, but I still feel better saying the statement in the latter scenario.

Let’s be fair by pointing out that the supplier may turn out to be absolutely right. The best opportunity to buy next winter’s propane may have been when front-month propane was at its zenith in late February. A buyer could have locked in price protection for this coming winter at around 80 cents then, and it would be around 85 cents today.

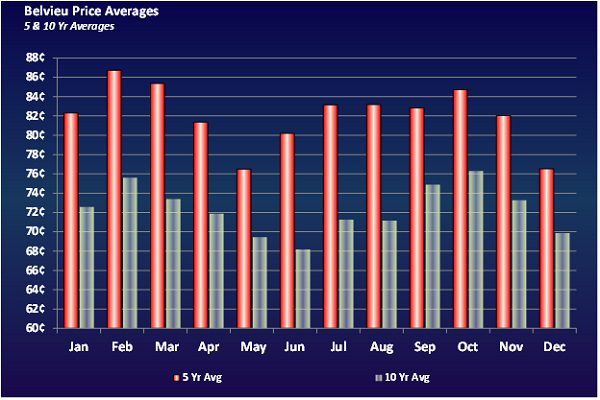

None of us know for sure where prices are going to be at any given point in time. But hedging is about playing the odds, playing the averages. Reaches and overreactions are almost always wrong. Again, a buy in February may turn out to be the best opportunity, but we like using the 10-year average for our guideline, and locking in 10 cents above it with the summer ahead doesn’t feel right.

And we will admit to a bias that the inventory situation is going to improve enough in the coming weeks to provide a better opportunity for buying next winter’s price protection. Let’s explore why that bias exists.

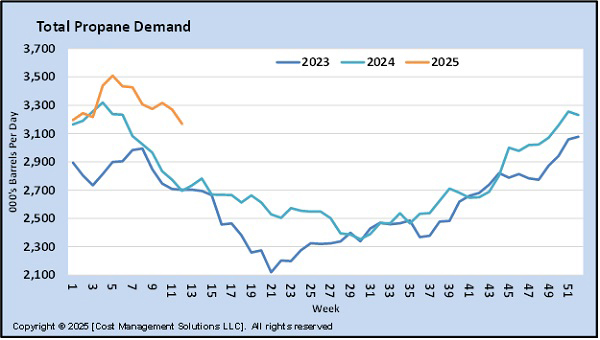

We used Chart 1 in last week’s Trader’s Corner to show how the sharp rise in demand related to the record-breaking winter storm in January had a lot of do with bringing down ready-for-sale propane inventories to their currently uncomfortable level, which is price supportive. We updated the chart with the latest data, and you can see that demand continues to fall as temperatures are moderating.

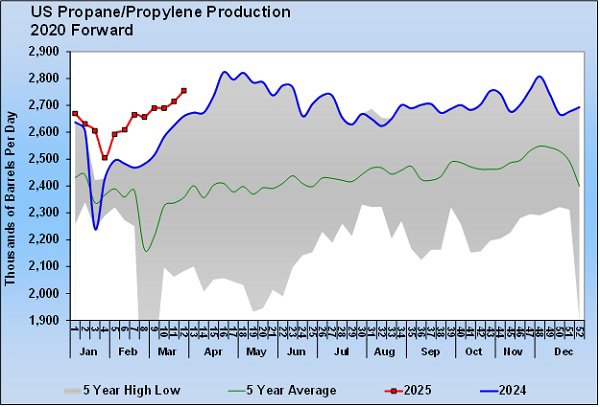

There appears to have been issues with Mont Belvieu fractionators that have made the situation worse. For example, in its last report, the Energy Information Administration (EIA) reported that total U.S. propane inventories were down just 190,000 barrels. However, ready-for-sale inventories were down by nearly a million barrels. That suggests Y-grade is still coming into the caverns upstream of the fractionators building propane inventories on that side, but the large drop in ready-for-sale inventories means something was amiss with fractionation and the propane in Y-grade was not processed into specification propane that could be sold. Consequently, propane inventories downstream of the fractionators declined.

Still, the chart shows that total propane demand is declining at a good pace and that should allow total propane inventories to build and, when the fractionator issues are resolved, if they aren’t already, ready-for-sale inventories will replenish as well.

At the same time demand is falling, U.S. propane production is climbing.

Therefore, we believe it is reasonable to think that a lot of what ails the propane market right now that has prices elevated will be resolved soon enough. In the meantime, we still have two or three months ahead of us that our old trusty price average chart shows there is the potential for a softer pricing environment.

As buyers, we must hope that the new export capacity that could be longer-term price supportive does not come online until later in the year. If so, better opportunities for price protection could present themselves over the next 60 to 90 days.

Even if propane prices fall in the front months during April, May and June, we don’t know if that will make prices for winter come down to better than they were in February. We may still have to give the supplier that said they would not come down his due. But overall, we believe the potential reward of waiting for a better opportunity over the next few months outweighs the potential lost opportunity that the supplier said existed in February.

Our risk is that we will go into next winter with less price protection for our customers than we would desire if that supplier was correct. It is a real gut-check to be sure. Keeping the wolves at bay is never easy.

All charts courtesy of Cost Management Solutions

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.