Far-out thoughts on buying propane

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, discusses the historical averages and the future of buying propane.

Catch up on last week’s Trader’s Corner here: Playing the averages may mean missing an opportunity

On Jan. 10, we wrote a Trader’s Corner about using the long-term price averages as benchmarks against current pricing as guides to help propane buyers get price protection at prices that are more likely to be beneficial to their customers. Propane is priced not just for the current month. It is priced routinely for 35 months out or forward of the current month. The plotting of those 36 prices (current month plus 35 forward months) is known as the forward price curve.

A little later, we will show a current forward price curve for Conway propane and revisit the importance of buyers expanding the buy window for price protection beyond the upcoming winter. But before we look at that forward curve, we want to discuss the historical averages for propane and why we believe it is currently best to choose the 10-year over the five-year average as your buying benchmark.

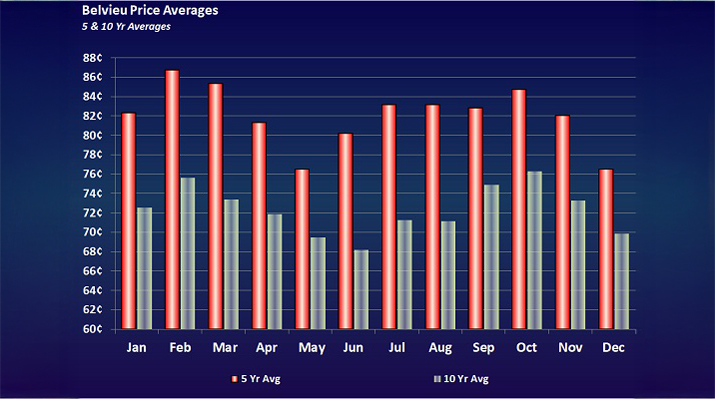

When the chart on averages was first put out, it was just for the 10-year average. However, some wanted to see the five-year average as well. The logic is that the shorter-term average is more likely to reflect current propane conditions and would be a better guide. However, we will argue that this is not currently the case.

We used the same chart below in last week’s Trader’s Corner, showing both the five-year and 10-year price averages. When we first used both, they were very close, so we were indifferent as to whether the buyer was using the five-year or the 10-year price average for guidance. But that changed when we dropped 2014 from the 10-year average and 2019 from the five-year average at the beginning of this year.

The year 2014 was high-priced for propane, averaging 101.0622 cents, so when that year came off the 10-year average, it dropped notably. Meanwhile, 2019 was a low-priced year, with an average of 53.0303 cents, so when it came off the five-year average, the five-year average was much higher.

Further, the high-priced 2021 and 2022 years caused by Russia’s invasion of Ukraine remained in the five-year average, which we think puts too much weight on that event in that average.

Our fear is that if buyers use the five-year average as their buying guideline, they will obtain price protection at a price that is too high. The 10-year average, of course, includes the Ukraine war anomaly but has enough years of what we would say are more fundamentally pure to bring the average down. The chart for Conway is very similar.

So, in this case, we believe the 10-year average better reflects propane’s historical pricing, providing the better buying guideline. Using the 10-year price average is certainly going to limit what will qualify as a buying opportunity, but we feel confident it is a better guideline for us until the Ukrainian war influence rolls out of the five-year price average.

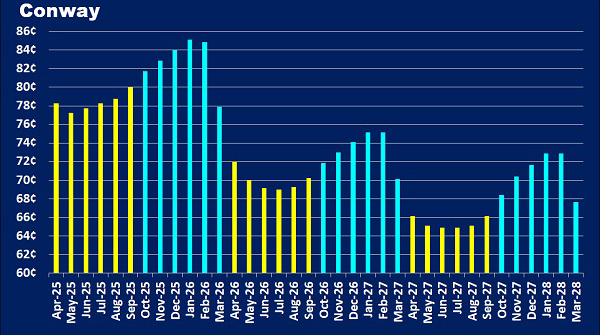

With that out of the way, let’s look at the current Conway propane pricing curve and compare it to the 10-year price average.

The blue bars are where the market is currently valuing propane for each of the next three winters. The current price average for October 2025-March 2026 is 83 cents; for October 2026-March 2027, it’s 73 cents; and for October 2027-March 2028, it’s 71 cents.

A buyer of a traditional pre-buy from their supplier is probably going to be limited to the winter of 2025-26. With April here, we are now in the traditional buy window for the upcoming winter. Propane retailers generally do much of their price protection buying from April through June. Whether getting that price protection from a pre-buy or by using swaps, the price offered to the buyer is going to be built from the current pricing of around 83 cents average.

Starting with the winter of 2023-24 and going back 10 winters, the average price of winter propane at Conway has been 73.76 cents. Using that 10-year average as the guideline, price protection for the winter of 2025-26 would be 9.5 cents higher than history. That greatly reduces the chance that owning 83 cents would be beneficial.

As we discussed last week, ready-for-sale propane inventories are low. That means buyers are having to bid up propane to get protection in the relatively short term. Sellers look at inventories and don’t see any need to be aggressive. As we said last week, we are hopeful that ready-for-sale inventories will recover over the next few months, giving buyers the opportunity to get price protection at the 10-year price average or below for the winter of 2025-26.

But right now, that simply isn’t where we are for that winter. It is our view that it would be a mistake to pay 9.5 cents higher than the 10-year price average for price protection, and we would rather go into this coming winter with less protection than we would like than lock in such a high price. We might end up regretting it, but that would be our discipline.

When our buy window is short (12 months or less), we are often put into this kind of dilemma concerning price protection. Opening the window helps mitigate short-term price pressures on the market. Conway buyers can price protect the winter of 2026-27 at 73 cents, which is a half-cent less than the 10-year price average, and the winter of 2027-28 is at 71 cents, 2.5 cents less.

We would not say that price protection at those numbers is a home-run opportunity, but it feels one heck of a lot better than 83 cents. One of the key advantages of using swaps as the base tool for securing price protection is the expanded buy window they offer.

Crude prices are usually backwardated in a well-supplied market. That means the price of crude in each month tends to be slightly lower than the month that preceded it. Since propane prices primarily are valued against crude, their price curve tends to be backwardated as well as reflected in the further-out part of the chart above. However, currently, propane fundamentals are coming into play, and propane for this coming winter is being priced higher relative to crude than is normal.

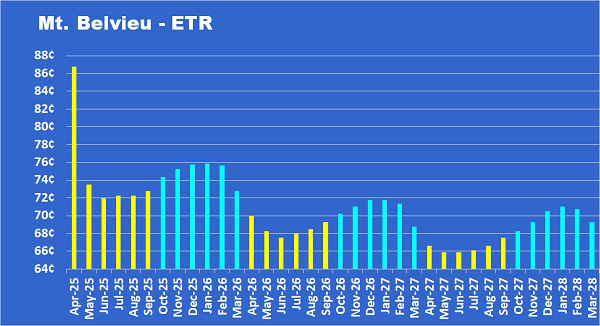

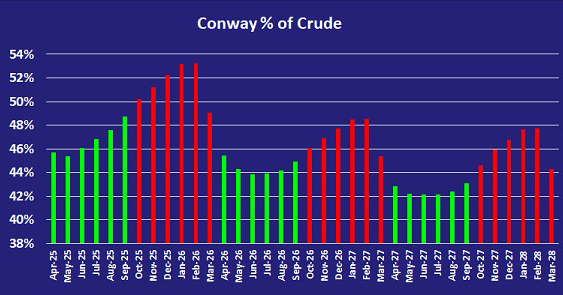

The chart above shows propane’s value relative to crude’s value in a simple percentage. It shows how pricey 2025-26 is relative to the further-out winters.

If retailers open their buy window to 36 months rather than 12 or less, as has historically been the case, they can greatly increase their chances of holding price protection that will be beneficial for their customers rather than a liability for themselves.

All charts courtesy of Cost Management Solutions

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.