A look back at 2024 propane pricing

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, looks back at propane prices in 2024 to get a baseline for decisions on 2025-26 price protection.

Catch up on last week’s Trader’s Corner here: Can the propane industry handle this winter storm?

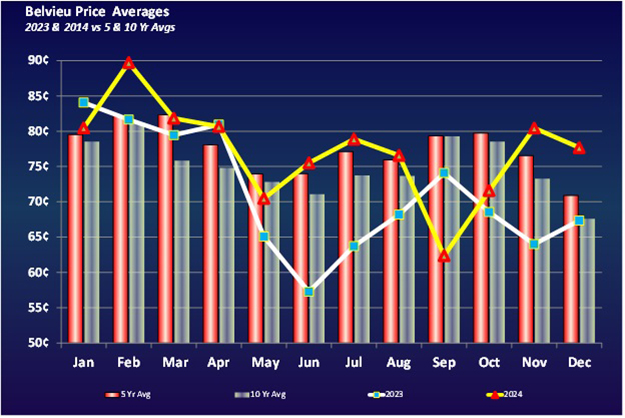

With 2024 firmly in the books, we thought we would look back on propane prices for the year. Taking a good look at 2024 pricing gives us a baseline for decisions on 2025-26 price protection. The chart below can be a useful tool for propane buyers as it allows them to easily see the price they should target for price protection.

The bars are the most important aspect of the chart above. The red bar is the five-year average for propane in a given month, and the gray bar is the 10-year average. We like the 10-year price average since it will reflect a wider range of market conditions, but either average will work. You can see there isn’t a significant difference between them.

Propane buyers will want to follow the forward price curves for propane and compare them to the chart above.

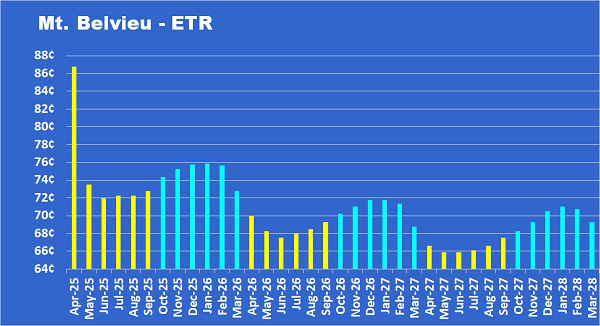

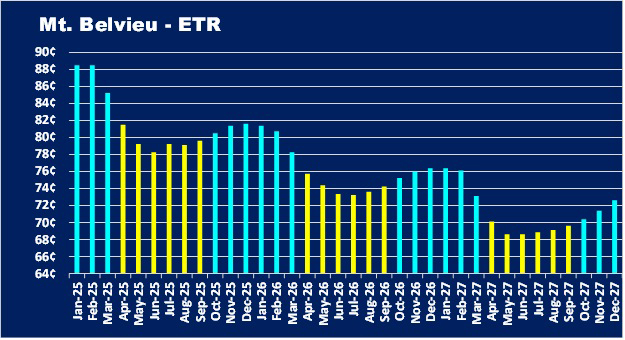

The forward price chart shows the propane forward price curve at 9:35 a.m. on Jan. 10. Daily readers of our report get this chart every day. Propane retailers can buy swaps in the current month and 35 months out to lock in prices that they will use to protect their customers from higher prices. When the strike price of the swap is above the five- and 10-year moving price averages for a given month, there is significantly more risk that the price protection will hurt rather than help the retailer and their customers.

A buyer wants to look for those months where the price of propane is lower than the averages. If price protection is obtained below the averages, the odds of the price protection working as hoped are greatly increased. And, of course, the further below the average a buyer can strike the swap, the better.

The forward price curve gives a very quick and easy visual of where the opportunities are currently. Obviously, the better opportunities are further out. With the recent run-up, prices are not good in about the first half of the curve. Buyers would want to look for opportunity beyond about the middle of 2026, and even then, some months aren’t great.

The opportunities are best for 2027. It is often the case that the better opportunities are further out and why we recommend that retailers expand their buying window to the full three-year period. If a buyer is only focused on the upcoming year, finding good buy opportunities gets harder.

Even if we buy below the averages, there is no guarantee that our price protection will work out. Let’s go back and look at the 2023 and 2024 prices in the top chart to illustrate that point.

The year of 2023 turned out to be a weak pricing year. There were only a couple of months where the monthly price average is above both the five- and 10-year price averages. There would have been a lot of retailers who bought price protection in those years who would not have been happy.

Keep in mind that price protection is designed to mitigate high-price markets for our customers so that the retailer can limit the price shock during high-price periods. We never want to overbuy price protection. We want to have plenty of propane we can buy at market prices so that we can remain competitive even in a weak pricing environment.

Even in 2023, if the buyer had been disciplined and only bought price protection when the market provided prices for a given month below the long-term averages, the negative impact of the price protection would have been much easier to manage.

In 2024, price protection bought below the long-term average prices would have worked out much better. In eight of the 12 months, prices averaged higher than the five-year and 10-year averages. Two other months were very close to the averages and would have worked out fine if the buyer had been diligently entering swaps only when the market provided a price below the average. That left just September and October where price protection was likely a liability for the buyer.

Buyers are probably only going to price protect about 40 percent of their expected sales volume unless the market gives them the opportunity to strike swaps well below the averages. That much price protection is enough to hold prices down in high-priced markets, which should help if customers are shocked by a bill and decide to shop. The price protection should allow the buyer to compare favorably to any competitor that did nothing to protect the customer from higher prices. That should improve the chances of retaining a customer upset by a high bill and consequently shops for another supplier.

On the other hand, at 40 percent price protection, there is still 60 percent of volume to be bought at market to make sure we stay competitive with retailers who did no price protection in a low-priced environment.

Yes, the buyer of price protection will likely be higher than his competitors who do not get price protection in a low-priced market. However, it is our contention that consumers are much less likely to shop for another supplier during periods when propane prices are low. A retailer’s “premium” pricing during those periods is far less likely to hurt in terms of customer retention.

In any case, using the charts above and being disciplined and forward looking with a wider buy window is going to greatly improve the chances of having the ability to price right in any market environment. By pricing right, we mean being priced in a way that has the greatest chance of retaining our valued customers.

All charts courtesy of Cost Management Solutions

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.