Propane inventories back on track

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explores the recent moves in propane inventories.

Catch up on last week’s Trader’s Corner here: Propane price movement driven by export terminal maintenance

For the week ending Sept. 20, the Energy Information Administration (EIA) surprised the market a bit. It reported a 1.547-million-barrel draw on U.S. propane inventory. That had the potential of making the inventory position of 99.107 million barrels for the week before the high inventory position heading into this winter.

From a historical perspective, peak inventories have been reached that early in the year before, but the second week of September would have been at the early end of the range. Inventories have peaked anywhere between the second week of September to the final week of November over many years.

What made the draw particularly unusual was that propane exports were trending lower, and temperatures have been well above normal, limiting domestic demand.

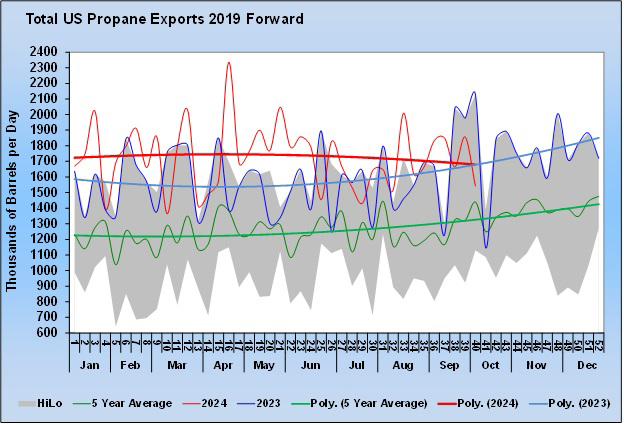

Chart 1: Total U.S. propane exports

The chart above shows propane exports. Though high, they have been trending lower since mid-summer. Exports have averaged 145,000 barrels per day (bpd) higher this year than last, but for the week of Sept. 20, the export rate was 377,000 bpd less than the same week last year.

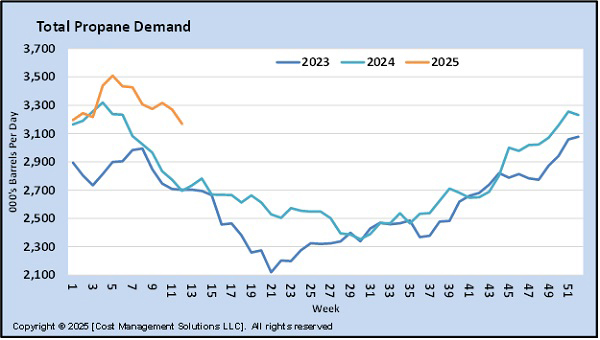

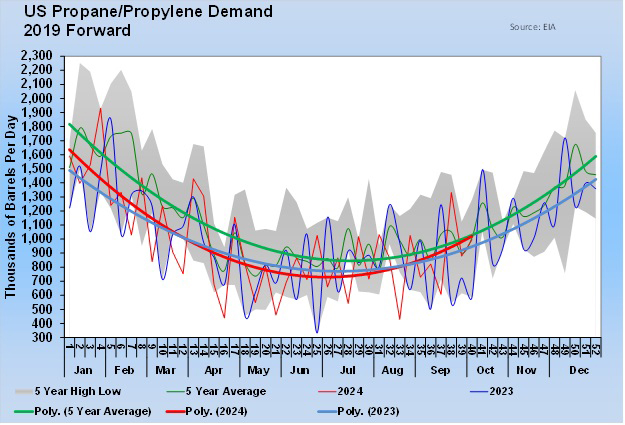

Chart 2: U.S. propane/propylene demand

The domestic demand chart above shows demand trending up, offsetting some of the slowdown in exports. The mild weather threatens that trend.

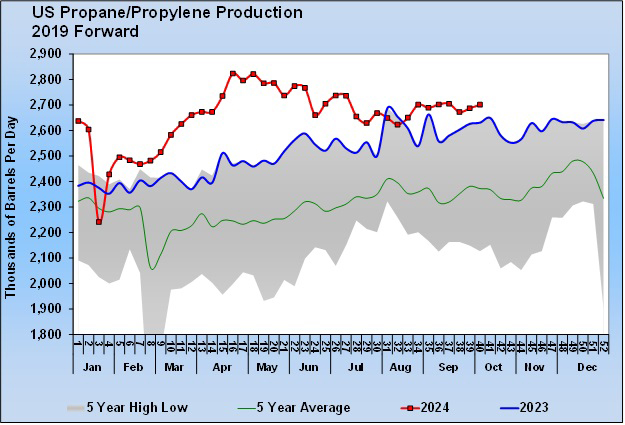

Chart 3: U.S. propane/propylene production

Propane production has also been trending up again after falling off through the summer. Production is setting new highs in most weeks of the year. Given these factors, it would have been totally unexpected if the inventories had reached their peak on Sept. 13.

The next week, the EIA reported a modest 263,000-barrel build in inventories, but that did not take the potential for the 99.107 million barrels on Sept. 13 being the inventory high.

However, a higher-than-expected 1.946-million-barrel build just reported by the EIA for the week ending Oct. 4 did end that possibility. Analysts were expecting a 1.2-million-barrel build, and the five-year average build for week 40 of the year had been just 202,000 barrels. Inventories now stand at 99.769 million barrels as a result of that large build.

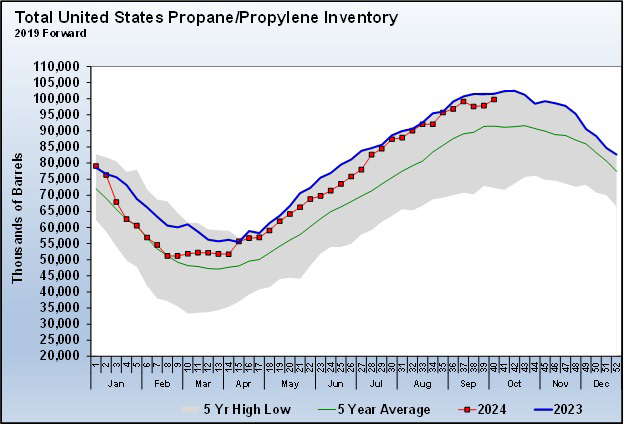

Chart 4: Total U.S. propane/propylene inventory

The inventory chart above shows the large build this past week essentially offset the impacts of the previous two-weeks’ inventory changes, putting the inventory build back on track.

Last week, we wrote about the craziness in propane pricing at Mont Belvieu being event driving. Inventories were impacted by those same events. There are new issues at Energy Transfer’s Nederland, Texas, export facility. It had compressor failures while restarting after a longer-than-expected round of maintenance work. Hopefully that issue is resolved soon, and pricing and inventory activity will get back to more normal and predictable conditions.

All charts courtesy of Cost Management Solutions

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.

Related articles: