Retailers had to be ready for anything this winter

When the temperature drops, propane demand rises.

This tendency means the winter is an important season for the propane industry. But every winter is different.

So, what happened this past winter? Was the weather different than what the industry expected? And how did the weather impact the propane industry?

Back in its October 2024 “Winter Fuels Outlook,” the U.S. Energy Information Administration (EIA) projected “that most U.S. households will spend about the same or less on energy than they did last winter, depending on a household’s main space heating fuel and the region where they live.”

At the time, the EIA retail energy prices were lower, but the agency also expected colder temperatures across much of the country, leading to increased energy consumption for space heating.

“The combination of lower prices and colder weather results in relatively little change in expenditures,” the EIA wrote.

The EIA’s exception was the Midwest, where the organization anticipated a return to more normal temperatures after a mild 2023-24, which would increase heating fuel expenditures by “between 2 percent and 11 percent, depending on the energy source, in the coming winter.”

“We assume this winter will be colder than the last winter across much of the country, especially in the Midwest,” the EIA said.

Expectations vs. reality

But the actual winter didn’t pan out quite as the EIA predicted.

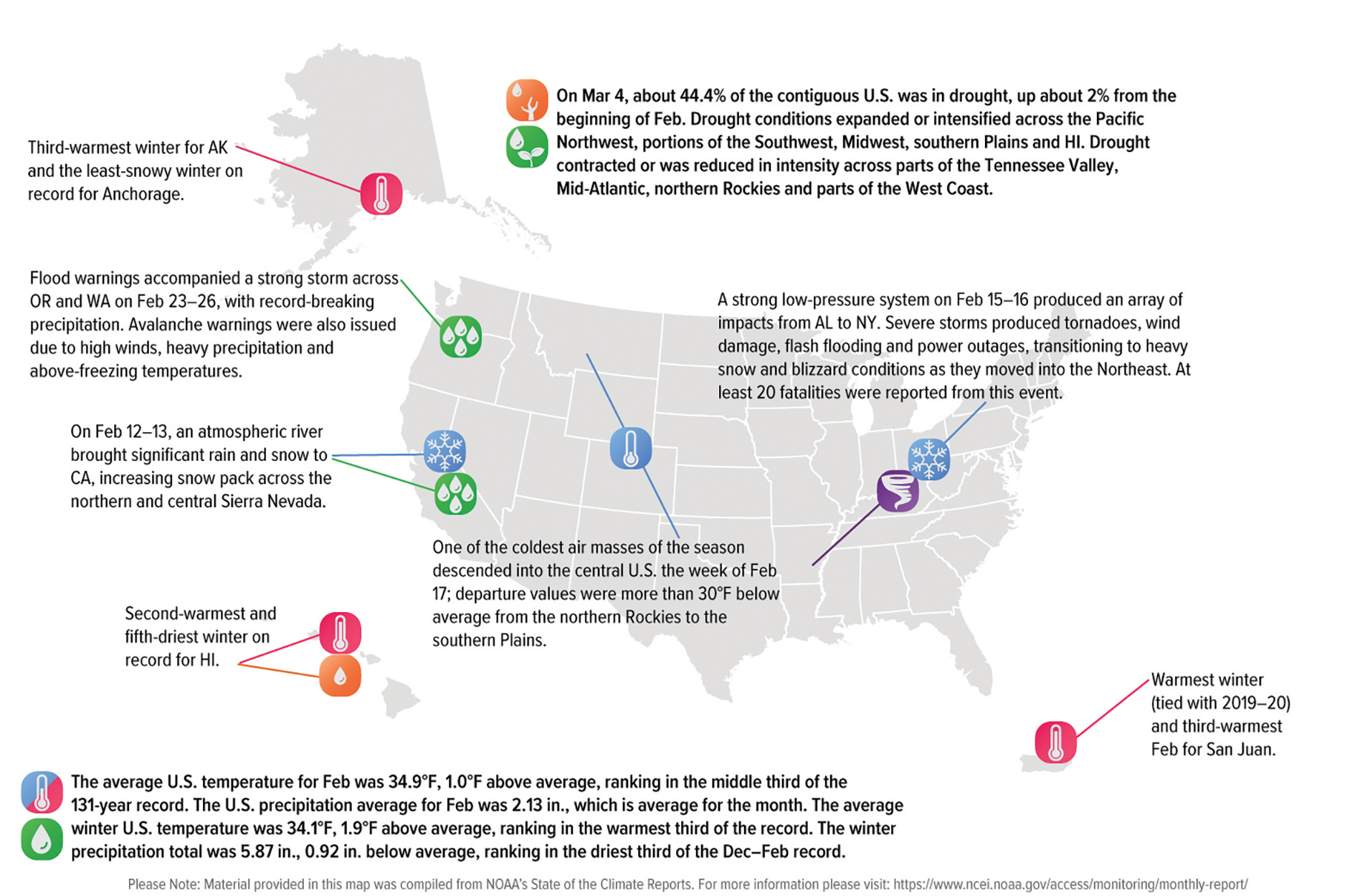

The National Oceanic and Atmospheric Administration (NOAA) reports the national average temperature each month this past winter and whether it was above or below average. Here is what the administration reports:

- October 2024: 59.0 degrees F, 4.9 degrees above average – the second-warmest October in 130 years.

- November 2024: 45.3 degrees F, 3.6 degrees above average – the sixth-warmest November in 130 years.

- December 2024: 38.3 degrees F, 5.6 degrees above average – the fourth-warmest December in 130 years.

- January 2025: 29.2 degrees F, 0.9 degrees below average – the coldest January since 1988.

- February 2025: 34.9 degrees F, 1.0 degree above average – ranking in the middle third of the 131-year record of average temperatures.

Although October, November and December were all warmer than average, January was cold enough to raise energy expenditures significantly, according to the EIA’s February projections, titled “Residential energy expenditures have increased with colder weather and higher prices.”

“Residential energy expenditures for homes heating with natural gas and propane for the current winter (November through March) have grown, and now we expect them to total 10 percent more than last winter,” the EIA states.

January’s cold weather “increased energy prices and consumption, both of which increased residential energy expenditures,” the EIA explains.

The EIA reports that January 2025 experienced 927 population-weighted heating degree-days (HDDs) compared to the typical 831 HDDs for January. These HDDs are “an indicator of heating demand, with more HDDs indicating colder weather,” the EIA states.

With the colder weather, U.S. propane inventories, which were previously high, decreased because of increased consumption and record-high exports, the organization says.

In addition, “Wholesale natural gas and propane prices increased in late 2024 and continued to increase in January,” the EIA states.

But the overall winter remained slightly above the average temperature, and by February, temperatures had increased again, according to the NOAA.

“The meteorological winter (December-February) average temperature for the Lower 48 was 34.1 degrees F, 1.9 degrees above average, ranking in the warmest third of the record,” NOAA says.

Reports from the field

But temperatures don’t tell the whole story.

To get the whole picture of what this winter was like for the propane industry, it’s important to hear from industry members. And they say this past winter was characterized by inconsistent weather.

“We had kind of a wild winter this year,” says Colin Sueyres, president and CEO of the Western Propane Gas Association (WPGA).

Sueyres notes that instead of consistent cold and snowfall, the region experienced periods of intense winter weather followed by warmer temperatures.

“We’d have a period of several days of intense winter weather,” he says. “You know, driving sleet and hail in the lowland areas, dumping snow in the highland areas. And then it would get warm, and things would mellow off – things would start thawing or melting, which made deliveries easier, thankfully. And then a few weeks later, bang! Another winter storm would pop up.”

This up-and-down pattern, while easier to deal with than a long period of consistent storms, required marketers to “think a little bit more proactively about supply,” Sueyres explains.

Sueyres notes that, in the Western states, supply and bulk storage have improved in recent years, largely due to lessons learned from severe storms in 2022, after which retailers increased bulk storage of propane for scenarios where sourcing propane was difficult.

“So, we have at least three additional bulk distribution rail terminals that have been built just in California alone since that winter heating season,” he elaborates. “We’ve increased the volume of bulk supply that we have pretty significantly.”

Outside of the western United States, the rest of the country also experienced inconsistent weather.

“This winter was marked by significant variability in weather patterns compared to last year,” says Michael Stivala, president and CEO of Suburban Propane, which has locations in 42 states. “While some regions experienced unseasonably mild temperatures, others faced periods of extreme cold and heavy snow. For instance, certain areas in the Midwest and Northeast saw colder-than-average stretches, while parts of the Southeast experienced warmer conditions. This contrast made it a challenging season for forecasting and operational planning.”

This variability, which Stivala also refers to as “sudden and unpredictable shifts in weather patterns,” was a unique challenge for many propane retailers this winter.

“These shifts required us to be more agile in reallocating resources and adjusting delivery schedules,” Stivala continues. “Additionally, some areas experienced supply chain bottlenecks due to snow and ice, which emphasized the importance of having local storage and contingency plans.”

Natural disasters

Of course, the cold and snow weren’t the only weather events that made the headlines this winter.

The propane industry also responded to some significant natural disasters: the wildfires in Los Angeles and the hurricanes in the southeastern United States. There was an outpouring of help – and propane – from retailers, as the industry played a role in clearing properties, providing fuel to first responders and supporting affected communities.

“The Los Angeles fires affected us in a couple of ways,” Sueyres says. “Part of what we do in the aftermath of fires, particularly in California, is work with fire agencies and volunteers from within the industry to clear properties and to let folks know when they can repopulate. So that’s usually the very first thing.”

Many retailers also donated propane to help in the recovery effort.

“We had a lot of folks who were donating gallons for fire crews and kitchens,” Sueyres says. “We were working with first responders and law enforcement so that we can get bobtails through to make deliveries, so that folks who needed fuel for whatever reason were able to get access to it.”

Suburban Propane had a similar response to not only the Los Angeles fires, but also the hurricanes that hit the Southeast this winter.

“During hurricanes in the Southeast or wildfires in Los Angeles, our priority is ensuring the safety of our employees, customers and infrastructure,” says Stivala. “We immediately deploy response plans that include rerouting deliveries, setting up temporary supply hubs and providing propane for emergency power generation. Additionally, we actively support affected communities by donating resources through our longtime partners at the American Red Cross and helping families in need. These experiences underscore the importance of adaptability and the strength of our nationwide network in maintaining service continuity.”

Sueyres adds, “Our industry did everything they could to respond, to provide fuel to folks who need it, to the first responders, to the victims. Cooking hot food, giving them hot showers, being able to give enough hot water for laundry. That’s a lot of the work that we did. And frankly, other than us, there’s really no other fuel, other than maybe diesel, that could do what we do anywhere you need to do it. That’s part of what our industry is so good at. Anywhere you can drop a tank, you’ve got energy.”

Plans for the spring, next winter

For propane retailers in many parts of the country, the end of the winter and transition into spring marks the end of the busy season. As temperatures rise, many places see lower demand for propane. But according to Sueyres, that’s not the case in the western United States.

“It’s a little bit different than some parts of the country in that while we do the bulk of our sales in that sort of seasonal winter space-heating season, we don’t rely on that winter heating season to make up all of our sales,” Sueyres explains. “We’re so large in the sort of traditionally smaller sectors like power generation, like materials handling, like agriculture.

“We’re making deliveries and procuring supply year-round. So, there’s no time to sit down and evaluate how we’re going to prepare for the next winter heating season, because we’ve got deliveries to make.”

Meanwhile, Suburban Propane is planning on expanding its offerings as the weather warms.

“This spring, we’re focusing on expanding our presence in markets like agriculture and outdoor living, where propane plays a vital role,” Stivala says. “We’ve also recently entered into a multi-year national partnership with NASCAR, becoming their official propane partner, which is a fantastic opportunity to reach new customers and educate them on the versatility, portability, reliability and clean-burning qualities of LPG.”

At the same time, Suburban Propane is preparing for next winter, too.

“At Suburban Propane, preparation for the winter season is a year-round effort,” Stivala says. “With operations across diverse climates, it’s critical to take a proactive approach to inventory management, workforce readiness and logistics planning. We leverage advanced forecasting tools to anticipate weather trends and ensure adequate propane supply in every market we serve. Additionally, our regional teams collaborate closely to adjust resources dynamically as weather conditions evolve. Investing in robust delivery systems, comprehensive employee training and maintaining strong relationships with supply partners are key strategies to ensure seamless service during peak demand.”

And with every winter, as with every challenge, there are lessons to be learned.

“Every winter brings unique challenges, but this past season highlighted the importance of staying agile and responsive,” Stivala says. “Unpredictable weather patterns and shifting customer demand reaffirmed the value of advanced analytics for supply chain optimization. We also learned that clear communication with our customers is crucial. Educating them on energy conservation, automatic refills and early-order options helps us manage demand surges more effectively. These lessons will guide our approach to planning for next winter, ensuring we remain ahead of any potential disruptions.”

Stivala expects that the weather will remain inconsistent.

“Looking ahead, we anticipate continued variability in weather patterns, which will require ongoing investments in predictive analytics and supply chain resiliency,” he explains.

Related Articles

January cold impacts US propane supply