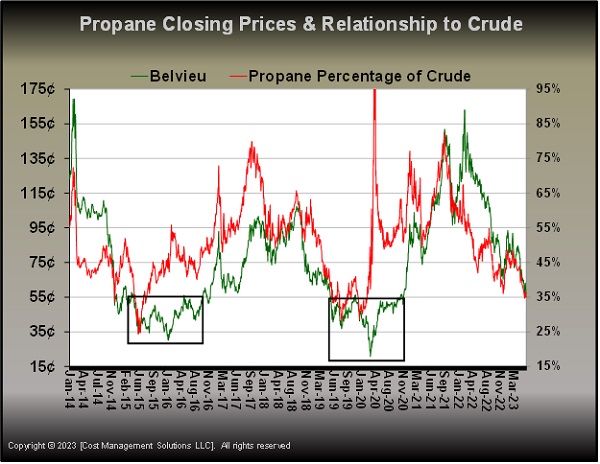

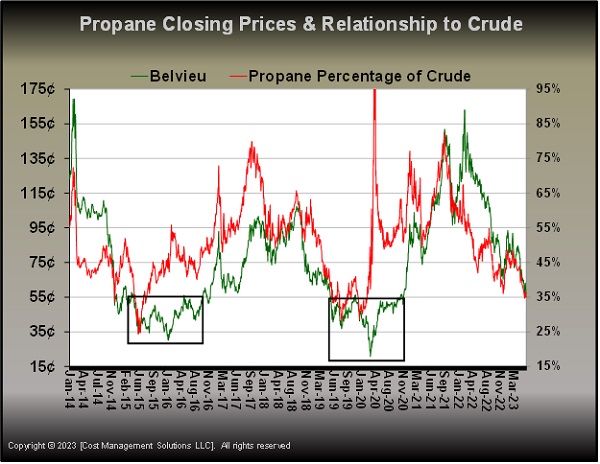

Propane prices point to buying opportunity

June 20, 2023 By Mark Rachal

The worst enemy of a good buying opportunity is the hope of a perfect buying opportunity, according to Mark Rachal of Cost Management Solutions.

Read More

The worst enemy of a good buying opportunity is the hope of a perfect buying opportunity, according to Mark Rachal of Cost Management Solutions.

Read More

Cost Management Solutions’ Mark Rachal evaluates how releases from the U.S. Strategic Petroleum Reserve will impact prices.

Read More

Because propane is a byproduct, its price is heavily influenced by what is going on with other commodities, namely crude and NGLs.

Read More

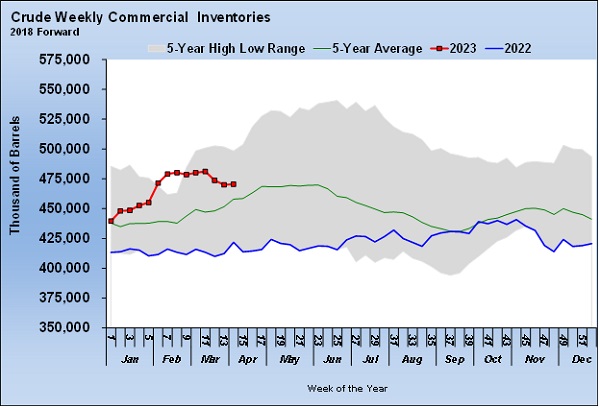

Despite high inventory levels at the propane trading hubs currently, we remain concerned about the potential for local market supply shortages during high winter demand periods.

Read More

Cost Management Solutions’ benchmark prices are at 50 cents per gallon for Mont Belvieu LST and $42 per barrel for WTI crude, but there is potential for a drop.

Read More

Developments in crude production and pricing should be watched carefully to see how that translates to propane production and pricing leading up to winter.

Read More

Cost Management Solutions saw prices move outside of the benchmarks for both crude and propane in the weeks after it shared its current short-term benchmarks with readers.

Read More

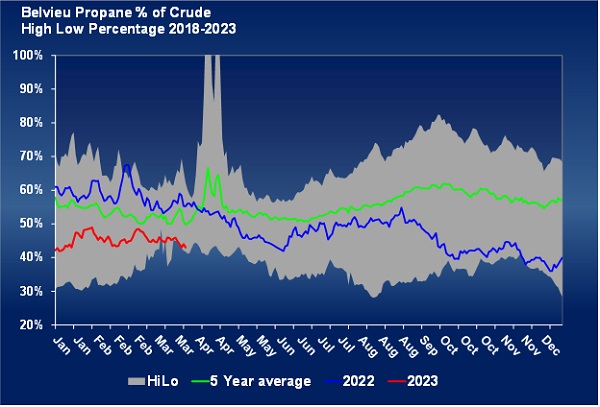

As fate would have it, propane pushed above 50.2 percent of WTI crude and 48 cents over the past week.

Read More

Propane fundamentals changed in 2020, causing the inventory overhang to be eliminated and pushing propane to the 50/50 marks.

Read More

Producers voluntarily shut production during April, and the associated natural gas liquids loss dramatically impacted propane fundamentals.

Read More