Update: Solving for the unknown in crazy April propane prices

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, gives an update on last week’s conundrum of April’s propane forward price curve.

Catch up on last week’s Trader’s Corner here: Solving for the unknown in crazy April propane prices

We are going to stay on the same topic as last week since there were a lot of interesting developments concerning the subject with the latest round of data from the Energy Information Administration.

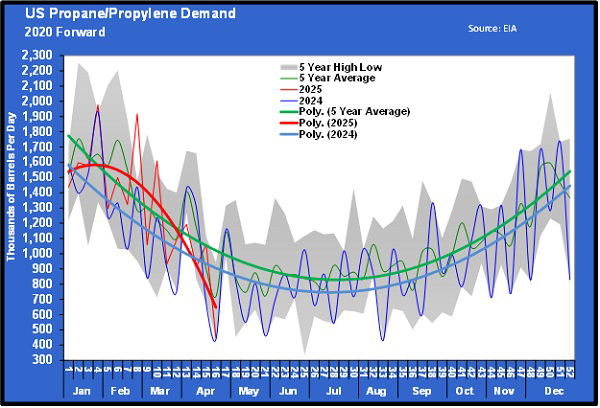

If you will recall last week, we looked at the supply/demand equation for clues as to why April propane prices have been so crazy. The conclusion was that propane supply was in great shape, that fractionators appeared to being doing their job and making a normal amount of ready-for-sale propane, yet inventories had a big draw for the week ending April 11. One could even say an unusually large draw. The reason behind this draw was very high demand.

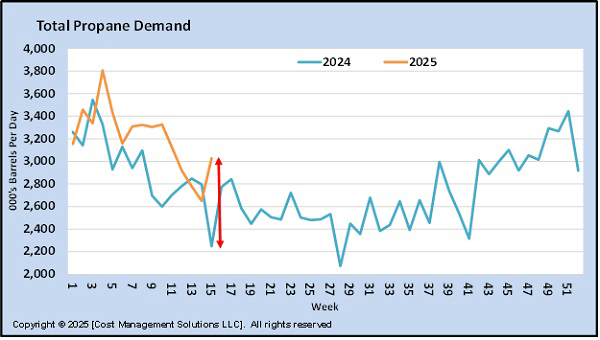

We showed Chart 1, illustrating the dramatic difference in total demand for U.S. propane from one year to the next:

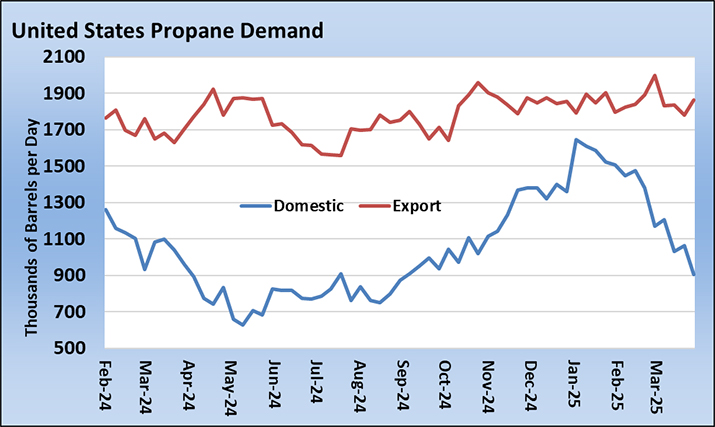

That was a 777,000-barrels-per-day-(bpd) difference in demand between this year and last year during the same week of the year. The high-demand difference was divided about equally between higher domestic and export demand. We also pointed out that ready-for-sale propane inventories increased 1.667 million barrels during week 15 last year and declined 1.603 million barrels during week 15 this year. That is a remarkable difference.

We finished last week’s Trader’s Corner with this comment about the high volumes of both export and domestic demand:

“We have also speculated that buyers of U.S. propane for export could be buying a lot in April, trying to get cargoes delivered before their country imposes tariffs on the U.S. That did not happen last year, and that could be an explanation for the dramatic year-over-year change. But where is all of the domestic demand during week 15 of the year coming from? That is a lot harder to explain.”

We also quipped about our inability to solve such complex equations as the reason we were force-promoted from the seventh grade onward. Well, it happened again. We don’t have to answer the question of why domestic demand is so high, because now it isn’t!

U.S. domestic propane demand dropped from 1.061 million bpd in week 15 to 448,000 bpd in week 16. That was a 613,000-bpd decrease in U.S. domestic demand. Even with a 195,000-bpd increase in export demand, U.S. propane inventories increased 2.263 million barrels, including a 1.518-million-barrel increase in ready-for-sale propane inventories. See, you don’t have to solve the equation; just wait a week, and you will be force-promoted.

Not only was there this good news on the demand side (at least for those of us trying to solve an equation, not necessarily for those selling propane), but there was good news on the supply side as well.

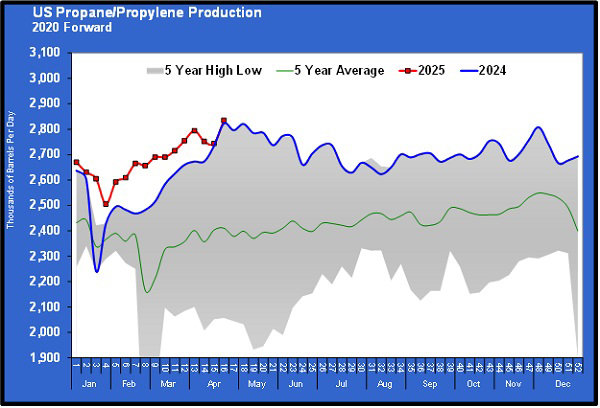

U.S. propane production set a record high at 2.835 million bpd, up 91,000 bpd from the previous week. The previous high was 2.823 million barrels set during the same week last year.

It is still our hope that this high level of production will remain around for a while, replenishing inventories and taking upward pressure off propane prices, allowing propane retailers to obtain price protection for their valued customers at better values. So far, this new positive data has not taken the pressure off of propane prices, which continue to surge higher, especially in the front month. April MB ETR propane is trading at 15.25 cents higher than May at 93.25 cents as we write on Friday, April 25.

MB ETR April propane is 20.25 cents above Conway and is trading at 63 percent of WTI crude. At this point last year, MB ETR was trading at 40 percent of WTI. The moral of this story is if life gives you complex problems that seem impossible to solve, just wait until next week (see solving the equation above). It looks like we will have to employ the same philosophy for buying propane price protection for the coming winters … see what next week brings.

All charts courtesy of Cost Management Solutions

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.